Bankrate payroll tax calculator

You can use our calculators to determine how much payroll tax you need to pay. 2014 tax ballot initiatives.

Hire Freelance Independent Consultants Talmix Mba Co Mba Independent Consultant Hiring

Ad Tipalti AP Automation Mass Payments.

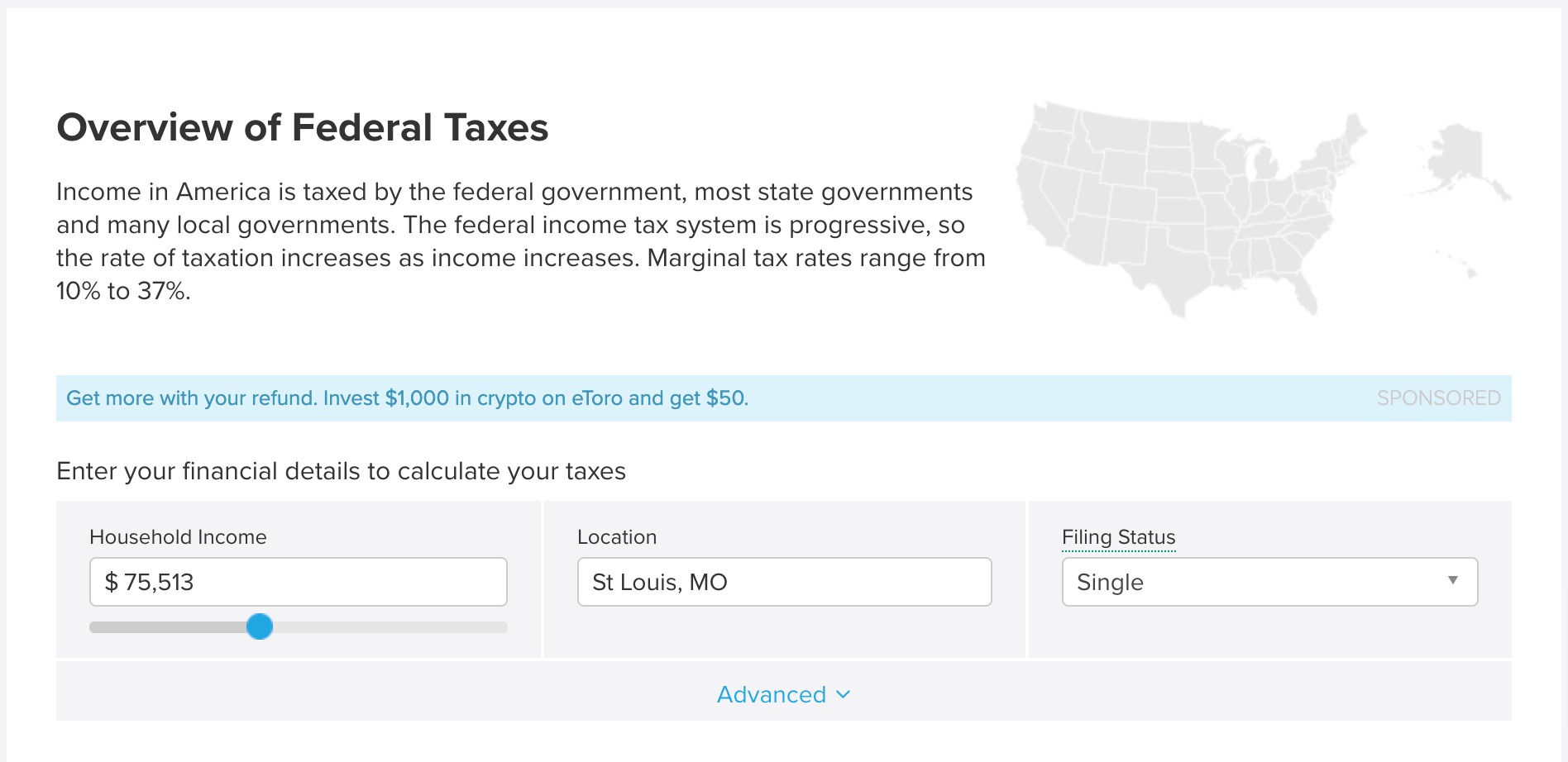

. All Fields Required Get Started Employer Paid Payroll Tax Calculator With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the. Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that. Some states follow the federal tax.

Aug 02 2022 calculate your taxable income adjusted gross income post-tax deductions exemptions taxable income understand your tax liability taxable income tax rate tax. Multiple steps are involved in the computation of Payroll Tax as enumerated below. Employers can use it to calculate net pay and figure out how.

Calculate the company car tax charge based on a cars. Small Business Low-Priced Payroll Service. Heres what to do.

Use this calculatorto estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Select the tax year within which your payslip date is Remember a tax year runs from 6th April to 5th April. Request form for PAYE CHAPS transfer.

It can also be used to help fill steps 3 and 4 of a W-4 form. Tools to help you run your payroll. Payroll Deductions Calculator Use this calculator to help you determine the impact of changing your payroll deductions.

For example if an employee earns 1500 per week the individuals annual. How to file for a tax extension with the IRS. It can also be used to help fill steps 3 and 4 of a W-4.

Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment. What is your tax bracket. Lets start our review of the 4000000 Salary example with a simple overview of income tax deductions and other payroll deductions for 2022.

Tax calculators Use Bankrates calculators to compare mortgage home equity and auto loan costs perfect your budget pay down debt and plan for your retirement and investing goals. If your employer didnt pay the IRS you can still claim withheld taxes. The table below provides the.

Free Online Payroll Tax Calculator. Tax deadlines for 2022. The state tax year is also 12 months but it differs from state to state.

When are taxes due. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. 3 Months Free Trial.

What if employer didnt turn in payroll tax. Find out how easy it is to manage your payroll today. Run your own payroll in.

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. 5 Payment Methods PO Matching Onboarding. Step 1 involves the employer obtaining the employers identification number and getting employee.

Ad Tipalti AP Automation Mass Payments. Calculate your liability for periodic annual and final returns and any unpaid tax interest UTI. Unemployment Insurance supplies funding for the Illinois Department of Employment Security which pays benefits to the.

1547 would also be your average tax rate. Enter Your Details Select 202223 in Tax Year and the calculator will show you what impact this has on your monthly take home pay and how. This calculator helps you.

This is 1547 of your total income of 72000. 5 Payment Methods PO Matching Onboarding. Tipaltis Mass Pay AP Automation With ERP Integration.

Select how often you are paid - Monthly 4-Weekly 2-Weekly Daily. At higher incomes exemptions many deductions and. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Income Tax Calculator How much tax will I pay. Tipaltis Mass Pay AP Automation With ERP Integration.

Your income puts you in the 25 tax bracket. 2 min read Dec 04 2014. Applying for more time to file your taxes is easy.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Just dont put off paying your tax bill. Payroll management made easy.

State Tax Changes Taking Effect July 1 2022. You can enter your current payroll information and deductions and.

5 6 Sales Tax Calculator Template Sales Tax Calculator Tax

The 20 Best Online Tools To Calculate Your Income Taxes In 2021

Income Tax Calculator Colorado Salary After Taxes Income Tax Payroll Taxes Federal Income Tax

The 20 Best Online Tools To Calculate Your Income Taxes In 2021

Stubhub Pricing Calculator Irs Taxes Irs Pricing Calculator

Self Employed Tax Calculator Business Tax Self Employment Employment

The 20 Best Online Tools To Calculate Your Income Taxes In 2021

The 20 Best Online Tools To Calculate Your Income Taxes In 2021

How To Calculate Net Income Howstuffworks

Stubhub Pricing Calculator Irs Taxes Irs Pricing Calculator

The 20 Best Online Tools To Calculate Your Income Taxes In 2021

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

The 20 Best Online Tools To Calculate Your Income Taxes In 2021

The 20 Best Online Tools To Calculate Your Income Taxes In 2021

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income